5 Personal Finance Mistakes to Avoid as a Freelancer

We’ve noticed many freelancers leaving the good life and going back to salaried jobs, which is purely to support a financial downfall. And there is nothing wrong with that. But if you treat your freelance job like any other profession, you will remain financially independent for as long as you like. In order to achieve this, it is crucial to manage your finances.

5 Personal Finance Mistakes to Avoid

Here are five common mistakes that freelancers make with their money, and tips for avoiding them.

1. Giving discounts to every client

We all may do some work for discounted prices now and then. But whom should you give a discount to? For starters, if you know someone personally, it may be a good idea to give them a discount. It helps you get your work out to more people. Trustworthy family members and friends will ideally fit this description.

Never give a discount to an unknown client. If you provide a reduced price the first time, they will only come back to you for this rate again, thereby reducing your earnings in the long run. Never provide discounts to a large corporation either.

If they promise you more work in the future, you, too, can promise them a discount in the future, but never for the first gig.

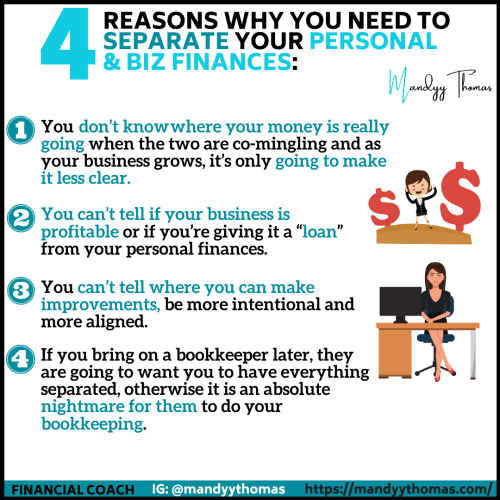

2. Not segregating business and personal expenses

As a freelancer, you are usually a one-person business. So you must also divide your earnings into business expenses and personal expenses. For example, subscriptions to a tool, membership fees, online account costs, and website costs—are all expenses you put back into your profession. So, you must count these as business expenses.

Based on how much you spend, account for a specific number for both your monthly personal and business expenses, and try not to overshoot it. This cash flow management is critical to help sustain your freelancing goals.

3. Ignoring taxes

If you have been freelancing for more than two years and have been avoiding doing taxes, you will get into trouble soon. Set up a meeting with a chartered accountant today! Find out if you need a GST number. Do you have to pay income tax? Do you have any TDS money you can claim back?

Taxation is something many never consider till the government comes knocking on their doors. The fines can add up over time, so please ensure you have your taxes in order. This also means you need to set up a streamlined payment and follow-up system. Create a consistent invoicing system with all the details, and always send them by email. If you are accepting cash payments, have that on record as well.

4. Collecting debt

Unlike salaried employees, the freelancing does not give you the promise of a fixed monthly income. This means you will have to ensure you do not build debt. It’s much harder to pay off if the markets do not move in your favor tomorrow. Additionally, don’t let a client put you in debt. If your payments are late, it’s your right to follow up and get your dues.

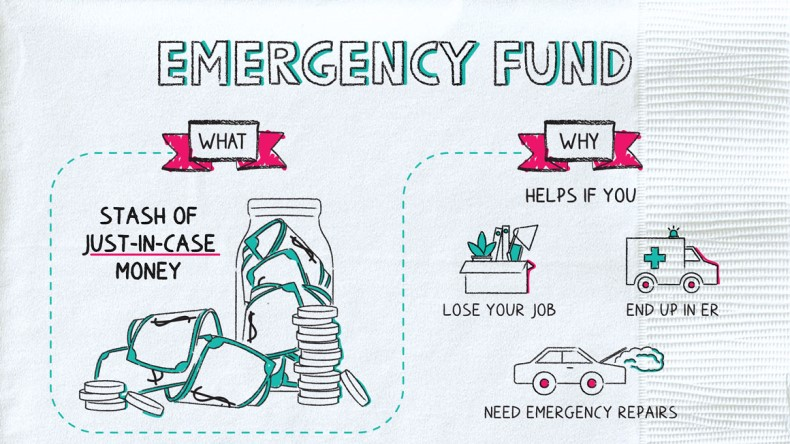

5. Not creating an emergency fund

Lastly, as a freelancer, you need savings more than anyone. They help you on a rainy day. Ask yourself whether you’d have enough money to replace your laptop if it were to stop working tomorrow. Or do you have enough saved for emergency medical treatment?

Your minimum account balance is not one the bank sets; it’s what you set for yourself. Slowly build four months’ worth of expenses as your backup. Additionally, park money in places you only remove in case of an emergency, such as a fixed deposit or an emergency fund.

It is imperative to consider investment options as a freelancer. Read about monthly savings plans and start one today. It’s easier on the pocket to spend a few thousand each month to build a backup fund than set aside a large chunk at once.

Many freelancers, especially beginners, avoid the role personal finance plays in ensuring their success. A sound personal finance management plan will help you sustain your business in the long run. To know more about personal finance for freelancers, you can watch this masterclass, where Sarthak Ahuja shares tips on handling money effectively as a content creator.

Latest Blogs

Explore how Google’s 2025 AI search updates triggered ranking chaos. Learn actionable strategies to adapt your SEO for AI Overviews, zero-click searches, and SERP volatility. Stay ahead now.

Learn how to rank on AI search engines like ChatGPT, Perplexity, and Gemini by optimizing your content for authority, structure, and relevance. Stay ahead in AI-driven search with this strategic guide.

Explore the best healthcare SEO services for your medical practice. Improve online visibility and effectively reach more patients in need of your services.

Get your hands on the latest news!

Similar Posts

Freelancing 101

5 mins read

11 Resources For Designers to Find Freelance Jobs Online

Freelancing 101

6 mins read

30 Freelance Industry Statistics to Get You Started

Freelancing 101

5 mins read